Gold IRAs: The Ultimate Retirement Investment?

Buy Gold Individual Retirement Account: A Comprehensive Overview

What is a Gold IRA?

A gold individual retirement account is a self-directed individual retirement account (INDIVIDUAL RETIREMENT ACCOUNT) that enables you to purchase physical gold and various other rare-earth elements. Gold IRAs are similar to traditional and Roth IRAs, yet they offer the included benefit of diversification and prospective defense versus rising cost of living and financial instability.

Why Buy a Gold individual retirement account?

There are several reasons you might wish to think about invest in gold IRA:

Diversity: Gold is an unique asset course that is not associated with the stock and bond markets. This indicates that it can help to expand your retirement profile and minimize your overall danger.

Inflation security: Gold has traditionally held its worth well throughout durations of inflation. This is due to the fact that gold is a finite resource and its worth is not connected to any type of government or reserve bank.

Economic instability: Gold is commonly seen as a safe house property throughout times of economic instability. This is due to the fact that gold is reasonably easy to shop and transport, and it is widely approved as a kind of payment.

Tax obligation advantages: Gold IRAs provide the same tax advantages as conventional and Roth IRAs. This indicates that you can contribute pre-tax or after-tax dollars to your account, and your incomes can grow tax-deferred or tax-free till you withdraw them in retired life.

Exactly how to Invest in a Gold IRA

To buy a gold IRA, you will certainly need to:

- Pick a gold IRA custodian. A gold IRA custodian is a banks that specializes in holding and handling physical rare-earth elements for IRA accounts.

- Open a gold IRA account. Once you have actually picked a custodian, you can open up a gold IRA account by finishing an application and funding the account.

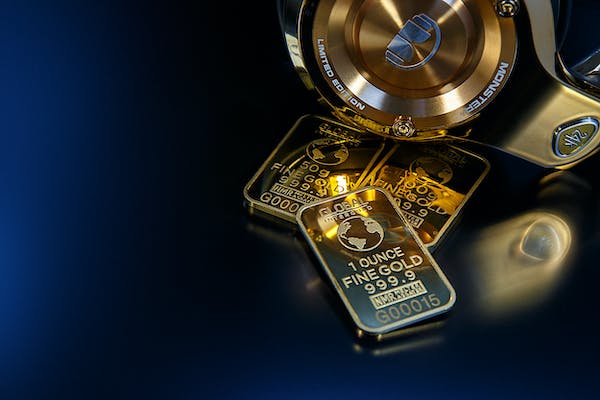

- Choose your gold products. You can pick to invest in a range of gold items, including gold coins, bars, and rounds. Make sure to select products that meet internal revenue service requirements for gold Individual retirement accounts

- Acquisition your gold products. When you have selected your gold products, you can buy them via your custodian. Your custodian will certainly after that store your gold in a protected vault.

Fees Associated with Gold IRAs.

Gold IRAs usually have higher fees than traditional and Roth IRAs. This is because gold IRAs require the acquisition and storage space of physical rare-earth elements. Typical costs associated with gold IRAs consist of:

- Account setup costs: These costs are generally charged by the custodian when you open your gold IRA account.

- Annual upkeep fees: These costs are billed by the custodian to cover the prices of saving and handling your gold.

- Transaction fees: These fees are charged by the custodian when you get or sell gold items.

- Storage fees: These costs are billed by the depository where your gold is saved.

Things to Think About Prior To Investing in a Gold individual retirement account

Prior to buying a gold IRA, make certain to think about the following aspects:

Your financial investment objectives: Are you purchasing gold for diversity, inflation protection, or economic instability? As soon as you recognize your investment goals, you can establish how much gold to purchase and for how long you plan to hold it.

Your financial investment perspective: Gold is a long-term investment. If you are intending to retire in the following few years, gold may not be the best financial investment for you.

Your threat tolerance: Gold is a fairly unpredictable property. If you have a low threat resistance, gold might not be the best financial investment for you.

The costs connected with gold Individual retirement accounts: Gold IRAs typically have greater charges than conventional and Roth IRAs. Be sure to factor in the fees when making a decision whether or not to invest in a gold individual retirement account.

Purchasing a Gold IRA: Advantages And Disadvantages Discussed

Gold IRAs are a kind of self-directed individual retirement account (INDIVIDUAL RETIREMENT ACCOUNT) that permits you to buy physical gold and various other precious metals. Gold IRAs use a number of possible advantages, including diversity, rising cost of living protection, and financial stability. Nonetheless, there are also some prospective disadvantages to think about prior to investing in a gold IRA

Pros of Purchasing a Gold individual retirement account

Diversity: Gold is an one-of-a-kind possession class that is not correlated with the stock and bond markets. This suggests that adding gold to your retired life profile can assist to lower your general danger.

Inflation protection: Gold has actually traditionally held its value well throughout periods of rising cost of living. This is because gold is a limited source and its value is not linked to any kind of federal government or reserve bank.

Economic security: Gold is typically seen as a safe house asset during times of economic instability. This is due to the fact that gold is fairly simple to shop and transport, and it is universally approved as a form of repayment.

Tax advantages: Gold IRAs supply the same tax obligation advantages as conventional and Roth IRAs. This suggests that you can add pre-tax or after-tax bucks to your account, and your incomes can expand tax-deferred or tax-free till you withdraw them in retirement.

Disadvantages of Purchasing a Gold IRA.

Higher costs: Gold IRAs typically have greater charges than standard and Roth IRAs. This is since gold Individual retirement accounts call for the acquisition and storage space of physical rare-earth elements.

Lower returns: Gold has historically underperformed the stock market over the long-term. This suggests that you might not gain as high of a return on your financial investment in gold as you would if you bought supplies.

Liquidity problems: Gold can be a difficult possession to offer rapidly. If you need to access your cash money swiftly, you may need to market your gold at a discount.

Storage issues: Gold is a physical asset, so you will need to keep it in a secure location. This can be expensive and troublesome.

Final thought

Gold IRAs can be an excellent way to expand your retired life portfolio and safeguard your cost savings from rising cost of living and economic instability. However, it is essential to comprehend the threats and costs associated with gold IRAs before spending. If you are considering investing in a gold IRA, make certain to consult with an economic consultant to figure out if it is right for you.

Additional Tips for Purchasing a Gold individual retirement account

Below are some additional tips for purchasing a gold individual retirement account:

- Do your study. Before you open up a gold IRA, make sure to research study various gold individual retirement account custodians and compare their charges and solutions.

- Choose a credible custodian. Make sure to select a gold IRA custodian that is reputable and has an excellent track record.

- Be aware of the internal revenue service needs. There specify internal revenue service needs for gold Individual retirement accounts. Make certain to acquaint on your own with these demands prior to you spend.

- Buy gold for the long term. Gold is a long-term financial investment. Do not anticipate to get rich quick by investing in gold.

- Screen your financial investment. As soon as you have invested in gold, it is important to monitor your financial investment frequently. This will certainly help you to track the efficiency of your gold and make necessary change.